India’s Wealthy Embrace AI Investments Through Secondary Markets

In a rapidly evolving financial landscape, India’s affluent investors are increasingly turning their attention to the burgeoning field of artificial intelligence (AI). This trend is not merely a passing interest; it reflects a significant shift in investment strategies as high-net-worth individuals (HNWIs) and family offices seek to capitalize on the explosive growth of AI technologies.

The Surge in AI Investments

The past 12 to 18 months have seen a marked increase in investments directed toward AI and space technology. According to Viram Shah, founder and CEO of Vested Finance, a firm that aggregates investor capital for participation in these high-stakes opportunities, the interest from HNWIs and institutional investors has intensified. “We’ve seen a notable shift toward these sectors, particularly in AI,” Shah stated, highlighting the urgency with which investors are pursuing these opportunities.

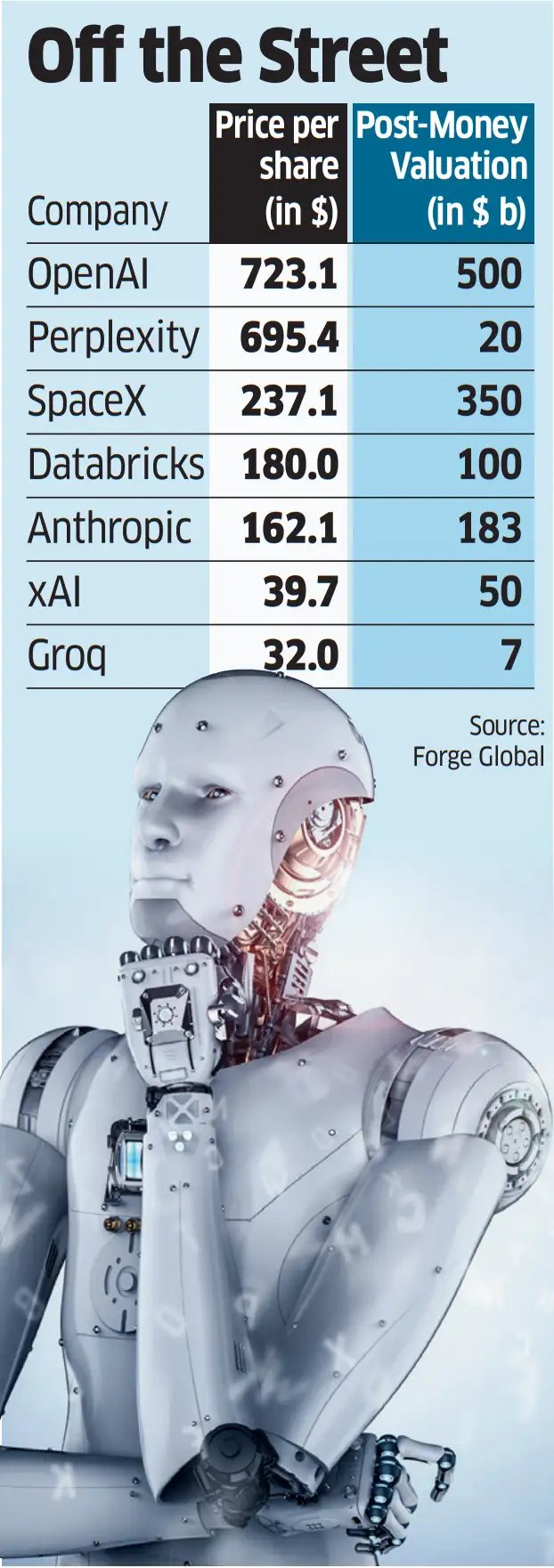

Platforms like Forge Global and Nasdaq Private Markets (NPM) have emerged as vital conduits for trading unlisted shares of tech giants such as OpenAI and Anthropic. NPM, which facilitates transactions for around 15,000 private companies, reported a staggering $60 billion in trading volumes. Meanwhile, Forge’s Private Market Index, which tracks late-stage, venture-backed firms, has surged by nearly 68% year-to-date, underscoring the robust demand for private equity in the tech sector.

The Mechanics of Private Market Transactions

Unlike traditional public exchanges, where stock prices fluctuate based on real-time market conditions, secondary marketplaces operate on an over-the-counter basis. This means that transactions are negotiated individually, often resulting in limited volumes and extended settlement periods. Pranab Uniyal, head of investment advisory at HDFC Tru, explained that “private share transactions are negotiated on a deal-by-deal basis,” which adds a layer of complexity to the investment process.

The allure of investing in these unlisted shares is clear. Investors are eager to acquire stakes in companies during their most lucrative growth phases. For instance, OpenAI’s valuation skyrocketed from $80 billion to nearly $500 billion within a single year, while SpaceX’s valuation increased from $210 billion to $350 billion, according to Shah.

As of the latest reports, shares of OpenAI were trading at approximately $723.12, Anthropic at $162.15, and Databricks at $180. These figures reflect the intense competition and demand for stakes in these pioneering companies.

Historical Context: The Magnificent Seven

The current enthusiasm for AI investments can be likened to the rise of the “Magnificent Seven” stocks-Apple, Microsoft, Nvidia, Alphabet, Amazon, Meta, and Tesla-that have dominated the tech landscape over the past decade. These companies have not only transformed their respective industries but have also generated substantial returns for investors. The recent surge in AI-related stocks is reminiscent of this earlier tech boom, suggesting that investors are once again looking to capitalize on transformative technologies.

Investment Routes for Indian Investors

For Indian investors, the pathways to engage in these lucrative opportunities are varied but often complex. The Liberalised Remittance Scheme (LRS) allows Indian residents to invest up to $250,000 annually in overseas markets, including the purchase of foreign shares. However, the minimum investment thresholds can be steep, often exceeding $100,000, as noted by Ankit Jain, a partner at Ved Jain and Associates.

Investors must also navigate a regulatory landscape that requires them to meet specific income or net worth criteria to qualify as accredited investors. Once qualified, they must remit funds under the LRS, which is subject to a 20% tax collected at source.

Challenges and Risks in Private Market Investments

While the potential for high returns is enticing, investors must also be aware of the inherent risks associated with private market investments. Uniyal cautioned that “private market shares are inherently illiquid,” meaning that they lack a readily accessible secondary market and may require long holding periods.

Moreover, the regulatory environment can be murky. If investments are not structured correctly, they may fall into a compliance grey area. Investors are advised to route their investments through regulated vehicles to avoid complications related to compliance and taxation. “The prudent route is via regulated structures in line with the Reserve Bank of India’s LRS, the Foreign Exchange Management Act (FEMA), and the Securities and Exchange Board of India’s AIF framework,” Uniyal emphasized.

Innovative Investment Structures

To mitigate some of these challenges, many investors are turning to special purpose vehicles (SPVs) to pool resources and make collective investments. These structures allow investors to hold shares until an exit opportunity arises, at which point proceeds are distributed based on each investor’s stake. Minimum commitments for SPVs typically start at $50,000, and participants may need to demonstrate a net worth of at least $1 million or an annual income exceeding $300,000.

For those who prefer not to establish offshore structures, alternative routes are emerging. Feeder funds, overseas alternative investment funds (AIFs), and vehicles registered in GIFT City are becoming increasingly popular for gaining exposure to global private companies. Additionally, exchange-traded funds and fund-of-funds, such as Mirae Asset’s Global X Artificial Intelligence Fund, offer another avenue for investors looking to tap into the AI boom.

Conclusion

As India’s wealthy investors increasingly turn their gaze toward the unlisted AI market, the landscape of investment is undergoing a significant transformation. The combination of high valuations, innovative investment structures, and a growing appetite for technology-driven opportunities is reshaping how wealth is managed and allocated. However, as with any investment, the potential for high returns comes with its own set of risks and challenges. Investors must navigate these complexities carefully to ensure compliance and maximize their opportunities in this exciting new frontier.