Gold Prices Soar Past $4,000: A New Era for Investors

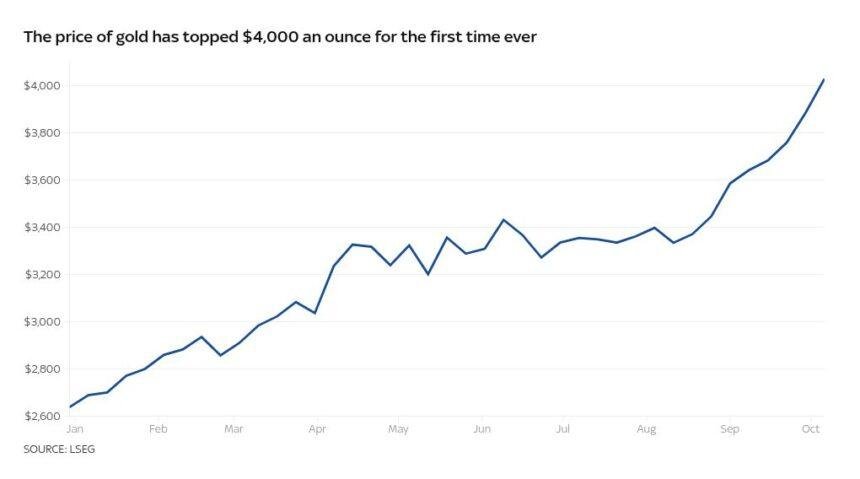

In a historic turn of events, the price of gold has surged past $4,000 an ounce for the first time, marking a significant milestone in the precious metal’s long-standing role as a safe haven for investors. As of early Wednesday morning, the spot price of gold reached $4,035, reflecting a remarkable increase from around $2,600 at the beginning of the year. This unprecedented rise has sparked discussions among analysts and investors alike about the underlying factors driving this trend and its implications for the global economy.

The Surge: What’s Behind the Record Prices?

The recent spike in gold prices can be attributed to a confluence of economic and geopolitical factors. Analysts have pointed to heavy outflows from the Bank of England as an early indicator of shifting investor sentiment. Traditionally viewed as a safe haven during turbulent times, gold has gained traction as a hedge against various uncertainties, including the ongoing U.S.-China trade war and a slowdown in global economic growth.

The current political landscape has also contributed to the surge. The ongoing crisis in France and the implications of a prolonged U.S. government shutdown have heightened concerns among investors. These events have led to increased volatility in traditional growth-linked stocks and the U.S. dollar, prompting many to turn to gold as a more stable investment option.

A Hedge Against Technological Uncertainty

Interestingly, the rise in gold prices has also been linked to the burgeoning artificial intelligence (AI) sector. As technology stocks have soared, driven by the promise of AI, some analysts argue that gold has become a collective hedge against the potential fallout from an AI-driven market correction. Despite the optimism surrounding AI, a recent report from the Massachusetts Institute of Technology revealed that 95% of businesses that have integrated AI into their operations have yet to see a return on their investment. This disconnect between hype and reality has led some investors to seek refuge in gold.

Ahmad Assiri, a research strategist at Pepperstone, noted that the $4,000 mark would test investor appetite but maintained a positive outlook given the ongoing global risks. “Selling gold at this stage has become a high-risk endeavor for one simple reason: conviction,” he stated. “Institutions, central banks, and retail investors alike now treat dips as buying opportunities rather than signs of exhaustion.”

Historical Context: Gold as a Safe Haven

Gold has long been regarded as a reliable store of value, especially during periods of economic uncertainty. Historically, it has served as a hedge against inflation and currency devaluation. The current surge in gold prices echoes past trends during significant economic downturns, such as the 2008 financial crisis, when gold prices also saw substantial increases.

The current economic climate, characterized by rising inflation rates and concerns over government debt levels, has further solidified gold’s status as a safe haven. As central banks around the world grapple with the implications of fiscal policies and geopolitical tensions, gold remains a preferred asset for those seeking stability.

The Market Dynamics: A Self-Reinforcing Cycle

The current market dynamics surrounding gold have created a self-reinforcing cycle. As prices rise, investor confidence grows, leading to increased demand. This behavior has shifted gold from a traditional hedge to what some analysts describe as a “conviction trade.” The notion that gold’s value transcends price reflects deeper doubts about policy credibility and the erratic nature of fiscal decision-making.

Investment firm GQG has reported that approximately 35% of the market capitalization of the S&P 500 Index trades at more than ten times sales, indicating that much of the investment in technology stocks is speculative. This speculative nature, combined with the uncertainty surrounding AI and other growth sectors, has led many investors to reconsider their portfolios and allocate more resources to gold.

The Future of Gold: What Lies Ahead?

As gold continues to break records, the question remains: what does the future hold for this precious metal? While the current momentum appears strong, analysts caution that market conditions can change rapidly. The interplay between geopolitical tensions, economic indicators, and investor sentiment will play a crucial role in determining gold’s trajectory.

Despite the potential for volatility, the consensus among analysts is that gold will remain a vital asset in the face of ongoing uncertainties. The collective behavior of investors, treating gold as a reliable hedge, suggests that the demand for the metal is unlikely to wane anytime soon.

Conclusion: A New Chapter for Investors

The recent surge in gold prices to over $4,000 an ounce marks a significant milestone in the financial landscape. Driven by a combination of geopolitical tensions, economic uncertainties, and the speculative nature of technology stocks, gold has solidified its position as a safe haven for investors. As the world navigates through these turbulent times, gold’s role as a reliable store of value is more relevant than ever. Investors will be closely watching market trends and geopolitical developments as they seek to navigate this new chapter in the world of finance.